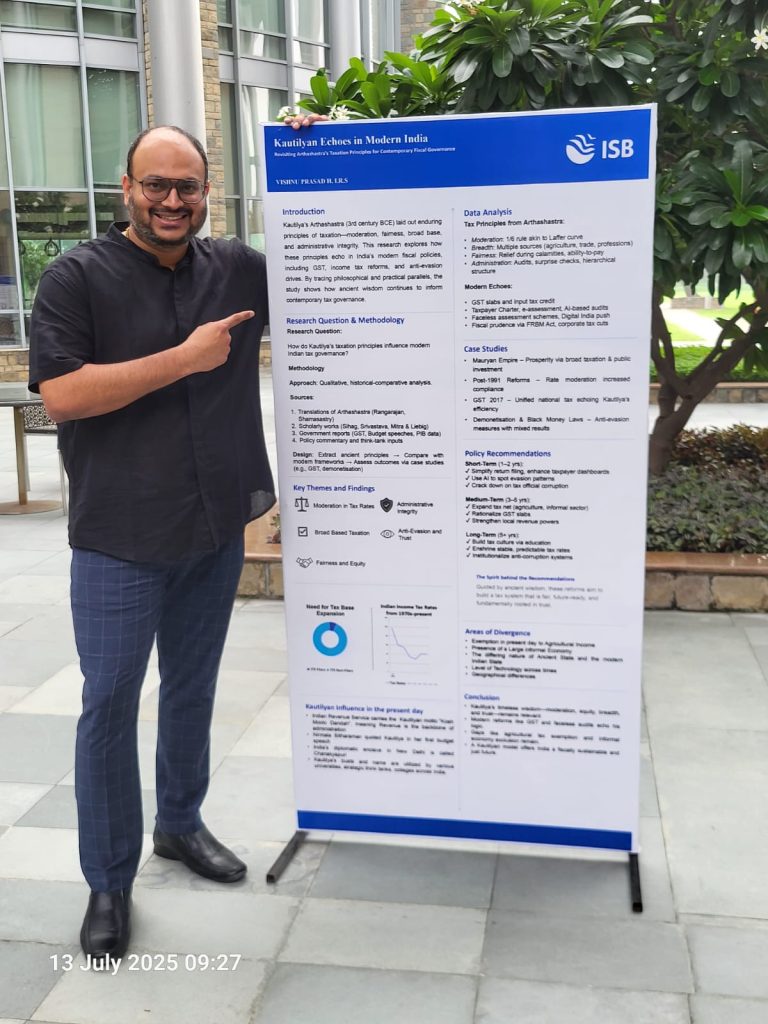

At the recent ISB Capstone Poster Walk, I had the opportunity to present a project that brought together two worlds I’ve long lived in — the study of history and the practice of taxation. Titled “Kautilyan Echoes in Modern India: Revisiting Arthashastra’s Taxation Principles for Contemporary Fiscal Governance”, this capstone represents a deeply personal intellectual journey that unites my postgraduate academic training in history with my professional life as an officer of the Indian Revenue Service.

Ancient Wisdom, Contemporary Relevance

Kautilya’s Arthashastra, written in the 3rd century BCE, laid down enduring principles for taxation: moderation in rates, fairness in burden, broad-based coverage, and strong administrative integrity. These ideas were not just philosophical—they were operationalised in one of the world’s earliest and most sophisticated systems of public finance.

My research explored how these principles remain astonishingly relevant in modern India’s fiscal architecture. Whether it is the design of GST slabs, taxpayer charters, AI-based assessments, or anti-evasion campaigns, echoes of Kautilya’s approach to taxation continue to shape our thinking and policies today.

The Research Approach

The project drew upon:

- Classical translations of Arthashastra,

- Scholarly works across history and public finance,

- Contemporary policy documents (from budget speeches to GST data),

- And case studies like the GST rollout, post-1991 reforms, and demonetisation.

Through this historical-comparative lens, I sought to identify how ancient tax wisdom could guide modern governance—particularly in an age of increasing distrust, evasion, and complexity.

Themes and Takeaways

Several key themes emerged:

- The importance of moderation in tax rates (a precursor to the modern Laffer curve thinking),

- The need for a broad tax base to ensure fiscal stability,

- The centrality of fairness and administrative trust, and

- The value of targeted audits and enforcement mechanisms to prevent revenue leakage without harming the compliant majority.

What stood out most to me, however, was not just the intellectual richness of Kautilya’s insights, but their moral clarity. His was a vision of taxation that sought not to extract, but to enable — to fund public prosperity while upholding citizen dignity.

The Personal Confluence

For me, this capstone was more than a policy exploration. It was a personal integration of two disciplines that have shaped me. My background in history has trained me to look beyond the moment—to see patterns, philosophies, and long arcs. My career in taxation, on the other hand, has grounded me in the real-world challenges of policy implementation and governance.

Bringing these two lenses together felt natural. In a world often rushing toward the next big reform, I found it deeply grounding to step back and ask: what have we already known for centuries?

Looking Ahead

My recommendations in the capstone span short-term technical improvements (like better dashboards and AI tools), medium-term reforms (like rationalising exemptions), and long-term cultural shifts (like building a trust-based compliance ecosystem). But at the heart of them all is one idea: that good tax systems must be designed not only with economic logic, but with ethical wisdom.

In re-reading Arthashastra, I was reminded that governance, at its best, is not just about raising revenue—it’s about building a just state.